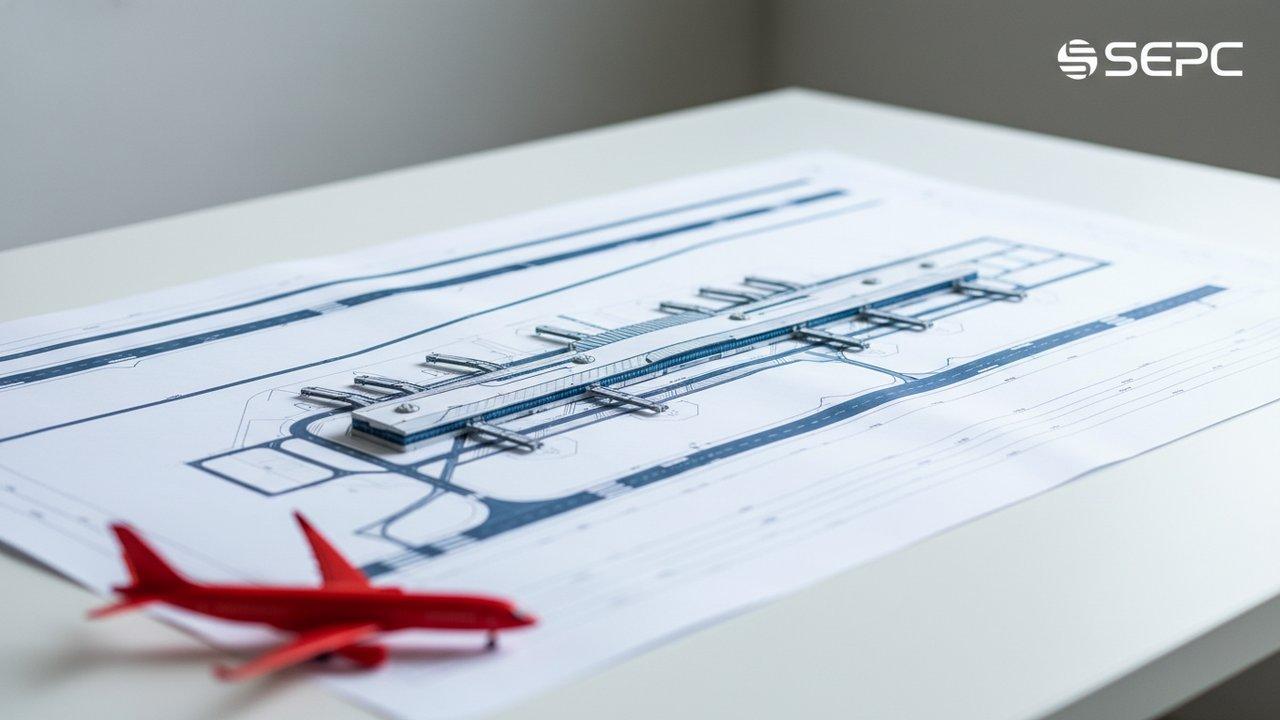

SEPC Secures ₹86 Crore Airport Deal While Stock Nears 52-Week Lows, Signaling Undervaluation

Show Table of Contents

- Catalyst: SEPC-Furlong JV wins ₹86 crore contract for Bihta Airport civil enclave in Patna.

- Verdict: Limited formal analyst coverage; stock trades at 0.93x book value.

- Key Level: ₹8.51 support (52-week low) / ₹9.90 resistance (December high).

SEPC Limited just landed an ₹86 crore airport deal. The SEPC-Furlong joint venture received the Letter of Award for a new civil enclave at Bihta Airport near Patna, Bihar. The scope covers full EPC delivery: integrated terminal building, utility structures, elevated road, electro-mechanical works, airport systems, IT and security installations. This adds to SEPC’s order book which stood at ₹1,055 crore as of December 2023. The contract is 8% of that book. The stock jumped 4% on news, hitting ₹9.17 intraday. That rally faded. SEPC now trades at ₹8.90, just 39 paise above its 52-week low. The stock is down 65% from its ₹25.45 high hit exactly one year ago. The disconnect is stark. Revenue grew 38.85% YoY in Q2FY26. Net profits jumped 262% to ₹8.30 crore. Yet the stock trades at a discount to book.

The market verdict is simple: no one cares yet. Formal analyst coverage is non-existent. Trendlyne tracks over 1,000 companies but can’t find enough analysts for SEPC to generate consensus estimates. Here’s the available “coverage”:

SEPC Limited (NSE: SEPC) – Analyst Views

| Source | Rating | Target | Date / Current Price |

|---|---|---|---|

| TradingView User | Bullish | ₹41-₹98 | 4-18 month view |

| ML Algorithm | Neutral | ₹8.35 | 2025 Target / ₹8.90 |

The machine learning model sees downside to ₹8.35. Retail traders on TradingView see upside to ₹98. That’s a 1,000% spread. This tells you everything about the information vacuum. The stock moves on news and retail flows. The 4% pop shows it can move fast when buyers show up. Valuation is cheap at 0.93x book. Revenue is growing at 38% YoY. But the market wants to see consistent execution before paying up.

Bulls are watching ₹9.90. That’s the December high. A close above that level would prove buyers have returned. The next resistance zone is ₹11.00-₹11.25, where the stock broke down in November. Bears are watching ₹8.51. That’s the fresh 52-week low. A break below opens the trap door to ₹8.00 and lower. Volume on down days has been heavy. Volume on up days has been weak. The key risks are execution and balance sheet. The joint venture structure splits risk but also splits control. Interest coverage ratio of 1.61x is thin. Promoter pledging at 33.95% adds overhang. Negative operating cash flow of -₹132.50 crore shows working capital stress. The setup is classic. A beaten-down small-cap showing fundamental improvement. The market hasn’t noticed. Traders are watching volume at key levels. The ₹86 crore contract is material for a ₹1,730 crore market cap company. Whether this marks a bottom depends on follow-through orders and margin improvement. For now, it’s a show-me story. The price action will tell the tale.

52 Week Range

Low: ₹8.51

High: ₹25.45

on Dec 9, 2025

on Dec 9, 2024

52 Week Low to All time High Range

Low: ₹8.51

All-time High: ₹377.00

on Dec 9, 2025

on Feb 18, 2008

Recent Returns

1 Week

-3.36%

1 Month

-18.39%

3 Months

-25.36%

6 Months

-34.46%

YTD

-60.32%

1 Year

-63.43%

News based Sentiment:

MIXED

SEPC: Profit Surge Meets Price Pressure

SEPC experienced a month of contrasting developments – a substantial profit surge and a major contract win were offset by significant share price declines and negative investor sentiment. This mixed performance creates uncertainty about the company’s future prospects, making it a crucial period for investors to assess its long-term viability.

Sepc – Peer Performance Comparison

Disclaimer: This blog has been written exclusively for educational purposes and does not constitute investment advice or personal recommendations. The author is not SEBI-registered as an investment advisor. Recipients should conduct their own research and consult a qualified, SEBI-registered investment advisor before making any investment decisions. Investments in the securities market are subject to market risks; read all related documents carefully before investing.